Buying a house is something that most Americans strive to do in their lifetime, and it can definitely be a rewarding endeavor. However, believe it or not, a single-family home has not historically been a great investment. We all need a place to live, and in many cases, buying can be better than renting since it helps build equity, but don’t think for a minute its not being paid for.

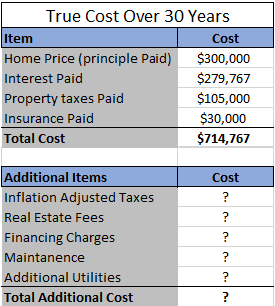

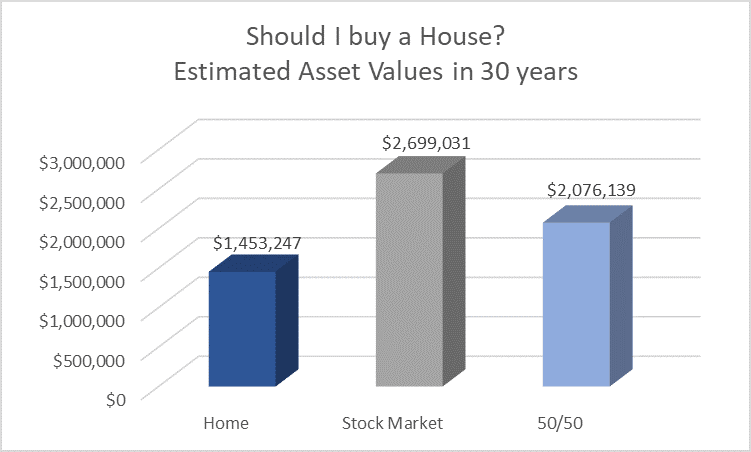

According to the Federal Reserve Bank of St. Louis, historical appreciation on owner occupied homes has averaged 5.4% from 1963 until 2018. If you bought a house now for $300,000, and historical averages prevail, it would be worth $1.45mil in 30 years, that’s not too bad on its face. That being said, there are a plethora of costs associated with purchasing and owning a home. For sake of simplicity, we are just going to look at the very obvious costs of home ownership. If you took out a loan for $300,000 at 5% interest for 30 years to buy your house you would pay $300,000 in principle payments and $279,767.35 in interest. Additionally, if we estimate property taxes at $3500 per year that’s another $105,000 over 30 years, and $80 a month in insurance costs another would be another $30,000 over the life of the loan. Adding up all these costs gets you a total cost of $714,767.35, not including real estate fees, financing charges, maintenance, private mortgage insurance, or anything else for that matter. That means over 30 years you have made a total of 103.32% (market value less costs) or averaged approximately 2.4% per year, not so good. You add in the additional costs mentioned above and that number approaches zero.

This doesn’t mean you shouldn’t buy a house; you need a place to live and its better than renting because it creates equity, but maybe don’t buy at the top of your budget. If you simply spend half as much and invested the rest in the stock market you could end up with a little over $2mil in total and still have a house of your own. See the chart below for visualization of these scenarios.

When buying a house, it’s important to not just think about what you can afford but also what makes the most financial sense. By contrast, if you just invested your monthly payments, of $1,985.46, in the stock market and got 8% per year return (below historical averages) you would have $2.7mil by the end of the 30-year period, that’s almost twice as much money.

Although there is still appreciation in asset value when you buy a single-family home, it isn’t very much. The reason buying too much house it is so high on our list of Net Worth Killers is because a house is most people’s largest lifetime purchase. To speak directly, when you buy a single-family home you are likely putting the vast majority of your wealth into an investment that is barely productive, so don’t spend more than you have too.

Buying too much house, or buying at the top of your budget, can literally put you in the poor house, pun intended.

Do you have additional questions? Give us a call at (800) 571-0076 or email us at info@delphiadvisers.com

You can also visit our website by clicking our logo above.

Mortgage details and estimations provided by https://www.mortgagecalculator.org/ using $300,000 loan at 5% interest over 30 years, $1,000 per year in insurance and $3,500 per year in property taxes. The example discussing investing “half” in a house and “half” in the market simply assumes all mortgage estimations are now half of what they were but terms remain at 5% over 30 years.