Step 1

Discovery Process

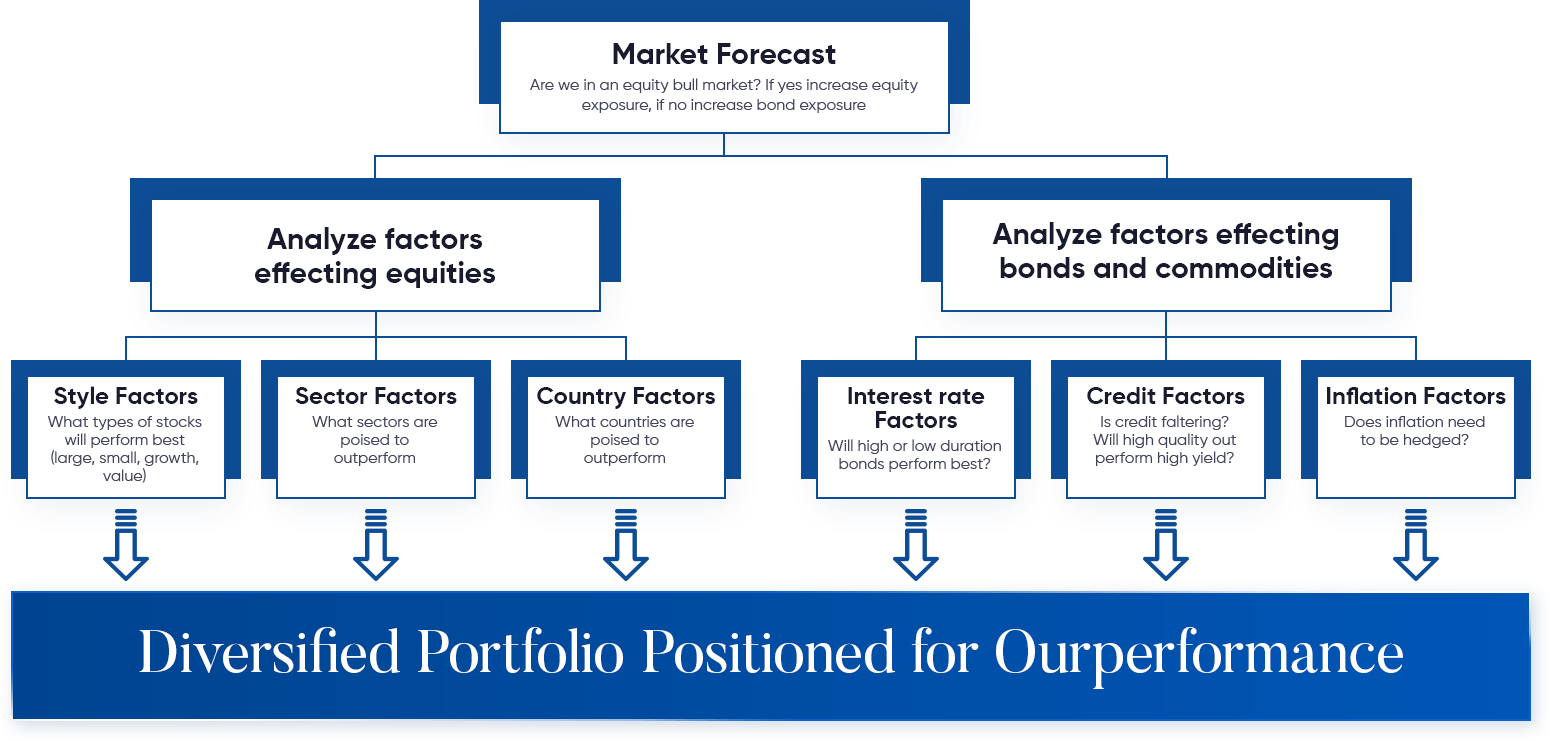

The Delphi Investment Management process starts with our clients. We spend as much time as needed to learn the ins and the outs of their financial lives. This ensures we have all the information needed to create the best possible investment portfolio to meet their long-term goals.