In case you didn’t know, a government shutdown is imminent and life as we know it will change forever………again.

Or, at least, that’s what the media and our government officials want us to believe. Well, that may be too harsh.

How about this?

They don’t care what we believe. They’re all making moves that are strategically designed to get ratings, clicks, and votes.

There, that’s better.

Despite my disdain for all the talking heads, there are some shreds of truth in what we are currently hearing from them. For instance, it is possible that we will experience some version of a “government shutdown”. What we don’t get from our favorite entertainment personalities (I include politicians here) is a reasonable assessment of what this turn of events means for us as investors, retirees, and citizens of this great country. They tend not to provide any context or relative perspective, and instead focus on words, phrases, and images designed to elicit emotion rather than encourage logical decision making.

In this article, we will try to provide the needed context and relative perspective that others do not, so that we can truly understand this topic and make educated logical decisions. We will cover what a government shutdown is, what it isn’t, the history of government shutdowns, and what a shutdown may mean for us and the markets.

What is a Government Shutdown?

Every fiscal year, the United States Congress is tasked with passing a budget to fund the discretionary operations of the United States government. (You read that right, DISCRETIONARY, more on that later.) This budget is passed in the form of 12 separate appropriations bills, which are created by their associated congressional subcommittees.[i] These subcommittees, and similarly named appropriations bills, are as follows:

- Agriculture, Rural Development, Food and Drug Administration

- Commerce, Justice, Science, and Related Agencies

- Defense

- Energy and Water Development and Related Agencies

- Financial Services and General Government

- Homeland Security

- Interior, Environment, and Related Agencies

- Labor, Health and Human Services, Education

- Legislative Branch

- Military Construction, Veterans Affairs, and Related Agencies

- State, Foreign Operations, and Related Programs

- Transportation, Housing and Urban Development, and Related Agencies

When Congress fails to pass all, or even some, of these appropriations bills, the government agencies that operate under the purview of these subcommittees in question do not receive their funding for the upcoming year. Without the necessary funding, one would assume that these agencies would just have to close their doors and “shutdown” until funding is received. Hence, the nomenclature “government shutdown”. However, in practice, it’s not quite that simple.

Many government agencies fund all or part of their operations through other fees, which they collect directly from individuals and businesses. Things like licensing fees, fines, and access fees are sources of revenue that these agencies can bring in that have nothing to do with the government budget and appropriations bills. For example, the Center for Disease Control (CDC) claims to bring in enough revenue to fund about 25% of its operations in perpetuity. Additionally, if appropriations funds from the previous fiscal year have not been spent, they can be used to fund continuing operations until those reserves run out. The National Gallery of Art, for instance, stated that it will be able to tap reserves in combination with other fees in order to remain open.[ii] On the plus side, many government agencies receive ongoing fees from the public that can fund a chunk of ongoing operations, but unfortunately, government agencies are not known for their fiscal planning and some may not be flush with spillover reserves from the previous year.

In addition, many of the jobs and functions within these government agencies are not allowed to be furloughed or ceased because they are deemed critical. For example, major job functions that fall within the military, law enforcement, transportation, and public health will mostly remain intact. While many of these employees will be forced to work without pay, once the associated appropriations bill is passed, they will receive back pay for their labor.[iii] As mentioned above, the CDC can fund about 25% of its operations through fees it receives, but another 25% of its employees are deemed critical and will continue to work throughout a potential shutdown. In all, at least 46% of the CDC will remain operating even if a shutdown takes place.[iv]

The Scope of a Government Shutdown

Now that we know what a government shutdown is, we need to understand the scope of such an event. The above list of subcommittees may seem very large and scary, but which functions are actually included in these areas?

According to the Brookings Institute, these 12 appropriations bills account for about 25% of total government spending.[v]

Let me reiterate that, the annual budgetary process accounts for only 25% of total government spending, and only a portion of this 25% will be affected by a shutdown due to other revenue received and jobs deemed too critical to furlough. That means that the other 75% is completely unaffected by Congress’ inability to pass a budget.

This brings us back to the idea of “discretionary budget” mentioned above. The government does not leave its core functions and entitlement programs up to the whims of politicians. These “non-discretionary” functions are funded in other ways, which are much less political and at far less risk of being shut down. This includes programs like Social Security and Medicare, which comprise about 36% of all government spending combined, as well as debt service in the form of net interest payments which make up another 11%.[vi]

A government shutdown isn’t really a shutdown, but more of a temporary reduction of non-essential functions. Businesses go through this perpetually as cycles shift and change, but when it is the government, people seem to get much more emotional about it. Even if a government shutdown takes place, most people’s lives will remain relatively unaffected. There may be some parks that get shut down, longer lines and wait times for certain services, and some pretty frustrated government employees, but life will go on.

Ironically, Congress’ salary falls outside of the scope of the budgetary process. So even though they are standing in the way of others getting a paycheck, their paycheck will continue to come no matter what they do. Surprise, surprise, Congress deemed their own pay too critical to leave up to themselves.

History of Government Shutdowns

Before the 1980s, government shutdowns did not occur the same way they do today. Although there were many instances of budgets not being passed, government agencies just continued business as usual with the assumption that a budget would be passed and they would be paid, eventually. Then in 1980 and 1981, Acting Attorney General Benjamin Civiletti provided a number of legal opinions stating that government agencies did not have the authority to continue operations without funding through appropriations.[vii] Thus, kicking off the modern age of political battles and government shutdowns.

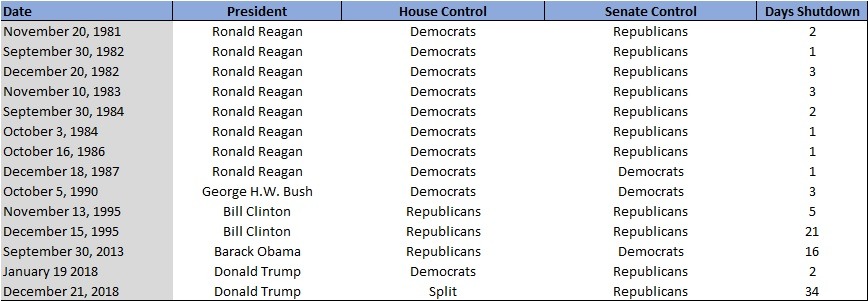

Since then, there have been a total of 14 government shutdowns lasting anywhere from 1 to 34 days, as depicted in Figure 1 below.

Figure 1: Government Shutdowns Since 1980[viii]

You may have noticed that in most of the shutdowns depicted in Figure 1, the President and at least one part of Congress represent different political parties. This is quite typical in government shutdowns, but why? In short, the House and Senate must agree on appropriations bills and then get the President to sign off on them. But, as always, different parties have different priorities, especially when it comes to talking points.

In general, Republicans have always, at least publicly, been in favor of reducing government spending, whereas Democrats have been more loose with the purse strings (in practice, both parties spend similar amounts of money, just on different things). Given that the budgetary process only effects about 25% of total government spending (and only discretionary spending at that), it provides a great opportunity for a political standoff that has very little lasting impact, but puts politicians in the spotlight to try and earn votes or pander to their base. These politicians take advantage of the fact that a typical American voter has very little understanding of all this, and far be it from them to attempt to inform us. They would rather take advantage of the opportunity to grab some attention.

In some cases, when Congress cannot pass the annual appropriations bills, they will trigger a government shutdown. However, in no way does this mean that budget standoffs aren’t constantly happening even when shutdowns don’t occur. As I stated above, this process is simply a perfect opportunity for politicians to find the spotlight. The far more common outcome of a budget standoff is the passage of a Continuing Resolution (CR). Basically, a CR is a stopgap measure that allows government agencies to be funded using the previous year’s funding levels for a short period of time. In fact, from 2010 to 2022, CRs were used 47 times.[ix] That equates to four CRs for every budget that was passed. Since 1977, there have only been two years in which no CRs were used (1989 and 1995). Meanwhile, in 2001, 21 CRs were used.[x] As stated above, the budget is a perfect political pawn and will continue to be used as such until the public catches on.

What a Government Shutdown Means for Investors

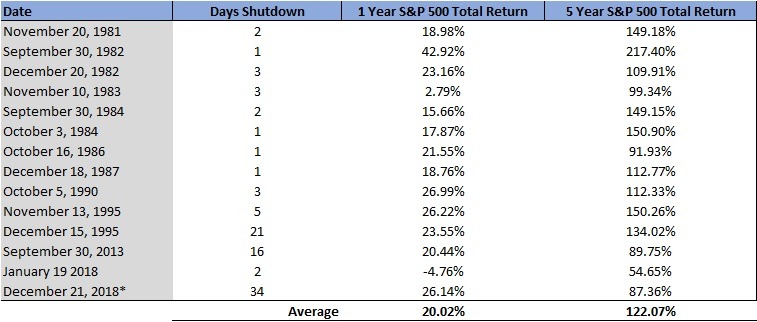

For investors, there is an entire other set of concerns surrounding a government shutdown. In particular, how will the shutdown affect portfolios. Well, it’s impossible to give a breakdown of how all portfolios will fair during a government shutdown because portfolios are as different as the people who own them. However, I can shed some light on how a government shutdown will affect businesses and equity markets. Let’s take a look at historic S&P 500 returns following government shutdowns in Figure 2 below.

Figure 2: S&P 500 One-Year and Five-Year Total Returns Following a Government Shutdown**

As you can see from Figure 2 above, S&P 500 returns have been overwhelmingly positive over both the one-year and five-year periods following a government shutdown. In fact, of the 14 instances in which the government was shut down, only one (2018) had a negative one-year return. Furthermore, there has never been a negative five-year S&P 500 return following a modern-day government shutdown. The negative return in 2018 was due almost entirely to a near 20% market correction in the last couple months of 2018. The S&P 500 was up about 5% from January to August of that year, so the negative return had nothing to do with the shutdown that took place months earlier. Additionally, the market correction was in full force long before the next shutdown took place in December of 2018.

The average one-year S&P 500 return following a government shutdown is about 20%, while the average five-year return is about 122%. Both of these numbers are far above average for equity markets.

If you were to look at a government shutdown as a market indicator, it would be overwhelmingly positive, not negative. There are, of course, a lot of variables to account for when it comes to why markets have been so overwhelmingly positive historically (too many to really analyze in an article like this). However, one very strong tailwind for markets over all these shutdown periods is the presence of a mixed government.

From a regulation standpoint, businesses fear large, sweeping legislation that can change the landscape in which they operate (think property rights and the redistribution of wealth). When this type of legislation is a possibility, business will reign in spending and wait to see what happens, which stifles the economy. When a mixed government is in place, it creates political gridlock and vastly reduces the likelihood of sweeping legislation being passed.

Markets love political gridlock! If parties can’t agree on a discretionary budget, how are they ever going to agree on anything impactful?

A word of caution, this doesn’t mean that we won’t see some short-term volatility in the event of a shutdown. In fact, I would expect a bit of negativity, but I wouldn’t expect it to last long. Different asset classes will react differently to the shutdown. Yields on treasury bonds and municipal bonds will probably rise a bit more than investment-grade corporates. Meanwhile, stocks of government contractors like Lockheed Martin and Boeing may see more of a short-term downside. But the key phrase there is “short-term”.

A government shutdown is not an indicator of a longer-term bear market or any other long-term negative consequences.

Times like this call for patience and discipline, not rash decision making.

If you have questions or would like a second opinion on your portfolio, please get in touch. We are here to help!

[i] https://www.crfb.org/papers/government-shutdowns-qa-everything-you-should-know

[ii] https://www.brookings.edu/articles/what-is-a-government-shutdown-and-why-are-we-likely-to-have-another-one/

[iii] https://www.npr.org/2011/04/07/135199130/essential-vs-not-which-jobs-are-exempt-to-shutdown

[iv] https://www.brookings.edu/articles/what-is-a-government-shutdown-and-why-are-we-likely-to-have-another-one/

[v] https://www.brookings.edu/articles/what-is-a-government-shutdown-and-why-are-we-likely-to-have-another-one/

[vi] https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

[vii] https://www.cbsnews.com/news/government-shutdown-history-congress/

[viii] https://www.cbsnews.com/news/government-shutdown-history-congress/

[ix] https://www.gao.gov/blog/what-continuing-resolution-and-how-does-it-impact-government-operations

[x] https://crsreports.congress.gov/product/pdf/R/R46595

**Data uses monthly average prices and is not taken from exact day of the month. Additional information on methodology can be found at http://www.econ.yale.edu/~shiller/data.htm

This content is developed from sources believed to be providing accurate information but Delphi Advisers, LLC does not warrant that this information will be free from error. This information should not be considered legal, tax, or financial advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security, investment, tax, or legal advice. Delphi Advisers, LLC is registered as an investment adviser in the state of Washington and is licensed to do business in any state where registered or otherwise exempt from registration