Markets continue to be extremely volatile due to fears of COVID-19, better known as the Coronavirus, but is it really warranted?

For many people, this virus has been very difficult and affected them in very adverse ways including loss of wages, illness, and even the death of loved ones, our thoughts and well wished go out to all those who have suffered during this difficult outbreak.

For us here at Delphi, we are forced to look at this event through an objective lens of markets and investing, so what does it actually mean? And more importantly, what should investors do?

Is a recession on its way?

Should people liquidate all their assets and stay in cash?

Should investors be buying gold or other commodities?

Is the sky falling?

To answer these questions, we need to look at this event in historical retrospect and see how markets and economies have reacted to similar events in the past. Believe it or not, this is not the first outbreak we have experienced, and it definitely won’t be the last.

Let us start by identifying some other historical outbreaks, some more recent and others in the more distant past but all will help us gain perspective on these types of events.

What we analyzed from most to least recent:

- Middle East Respiratory Syndrome (MERS) – 2012

- Swine Flu (H1N1) – 2009

- Severe Acute Respiratory Syndrome (SARS) – 2003

- Hong Kong Flu (H3N2) – 1968

- Asian Flu (H2N2) – 1957

- Spanish Flu (also an H1N1) – 1918

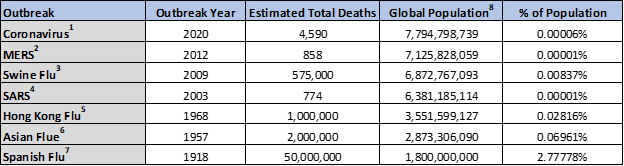

Reliable data on these outbreaks can be difficult to come by, especially going back as far as the Spanish Flu, but one statistic, that at least has good estimates, is the number of deaths. See below.

As you can see above, the current outbreak of the Coronavirus is indeed a problem, but by no means the worst we have seen in the last 100 years. Will it get worse? Maybe. But, as we approach warmer weather and take into account the advancement of the world’s virology studies and practices, its’ magnitude will likely be far less than things like Swine Flu, Hong Kong Flu, Asian Flu, and Spanish Flu. The absolute number of fatalities with the Coronavirus are undoubtedly sad, but, when looked at in historical retrospect, quite small. Especially when compared with common influenza that has killed between 300,000 and 600,000 people per year over the last 20 years9.

Short Term Market Impact

We have established that the Coronavirus has not progressed to the magnitude of some of the outbreaks we have seen in the past, but what does it actually mean for investors? What should they expect? Well, lets check with history.

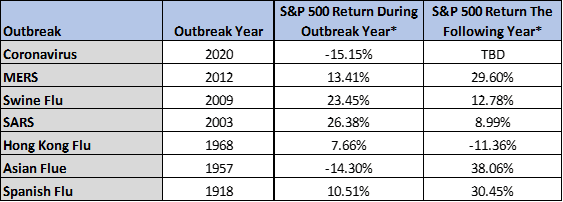

*The Dow Jones was used for 1918 and 1919 because it has better data10. Yahoo finance price return was used for all other return data, total return data is unreliable back that far11

Historically, the S&P 500 has been positive in about 70% of years, and even with global outbreaks, that statistic doesn’t seem to deviate too far from the average. In fact, the underlying fundamentals are probably more important in each of these years than the outbreak itself. That being said, the human toll is undeniable.

Long Term Market Impact

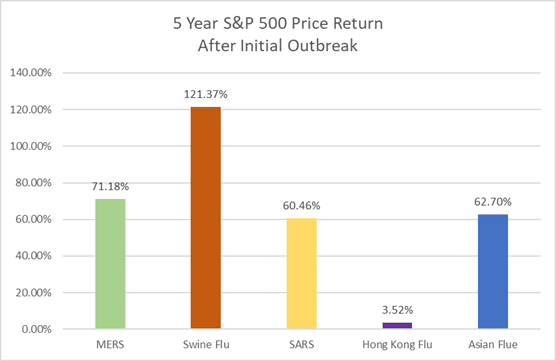

This is all fine and dandy, but most people have a much longer investment time horizon than 1-2 years. So, how did these outbreaks actually affect long term returns? Let’s take a look at the S&P 500 five years after each of these outbreaks occurred.

As the graphic depicts above, there was not a single negative 5-year period following these outbreaks, and keep in mind this is price return that does not include dividends, total return would be higher. The only outbreak that had a tough subsequent 5 years was the Hong Kong Flu that took place in 1968. As we know, the early 70’s was not a great economic environment. Things like the Vietnam war, price and wage controls likely weighed on the economy and stock returns far more than the outbreak itself, even though it killed about 1 million people.

Additional Considerations:

Governments across the world have taken quite drastic steps to try and stave off mass proliferation of the Coronavirus globally. Whether or not you, or we, agree with these actions is moot as they have been put in place, but they will have lingering effects. The Coronavirus has taken a human toll and it may get worse before it gets better but many of these government actions have not trickled into the economy yet. When the effects of these actions show up, they may have a fairly negative impact on global economies and could cause this market correction, and potential recession, to grind on for a number of months longer than expected.

What Does This Mean for My Portfolio?

It is very possible that the Coronavirus continues to get worse, but it is highly unlikely that we see anything to the degree of the Hong Kong Flu, Asian Flu, or Spanish Flu. Even if it does get much worse, history has taught us that markets will push through, but we don’t know when the bounce may start.

We need to make investment decisions on probabilities, not possibilities.

For those that have a solid portfolio strategy in place, the best decision is probably to stay the course and not make any rash decisions. This too shall pass.

For those that may not have the most efficient or effective strategy in place this is an excellent time to re-evaluate and prepare for the inevitable bounce.

If your portfolio has any of the below characteristics, it may be worth thinking about a strategy shift:

- Has fallen as much, or more than markets in this correction

- Didn’t perform well in 2019

- Invested in mutual funds

- Invested in insurance products

- Invested in REIT’s or private placements

- More than a few percent invested in gold or other commodities

- Has a high concentration in a country (including the US), sector, industry, or company

If you aren’t sure your portfolio is properly constructed, we are happy to do a free evaluation and give you our objective opinion.

Please feel free to give us a call at (800) 571-0076, request a call here, or schedule a consultation here.

To all our readers, and those afflicted by this outbreak, stay safe and healthy.

Sources and footnotes:

1https://www.worldometers.info/coronavirus/ (As of 3/11/20)

2https://www.cdc.gov/mers/about/?CDC_AAref_Val=https://www.cdc.gov/coronavirus/mers/about/index.html

4https://archive.cdc.gov/#/details?url=https://www.cdc.gov/sars/about/fs-sars.html

5https://archive.cdc.gov/#/details?url=https://www.cdc.gov/flu/pandemic-resources/1968-pandemic.html

8https://www.worldometers.info/world-population/world-population-by-year/

10https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart