If you watch the news, listen to the radio, or generally socialize with other people, you have probably heard the whispers (or screams) claiming that, if we are not in a recession already, then one is right around the corner.

But is there any truth or legitimacy to these claims?

The reality is that no one can know for sure, as there is no way to predict the future, at least not when it comes to predicting economic outcomes. The real question is: how likely is it that we are already in a recession or will be entering one shortly? This question can be answered, but probably not as clearly as we would all like. The “fuzziness” of the answer is not just applicable to our current time and place, but to any time in the future. With that said, this lack of clarity doesn’t mean that we can’t get a good idea by digging into the data, it means that we can never be 100% certain. Anyone who says otherwise is either ignorant or outright lying.

Negativity and Incentives:

What can be said with 100% certainty is that the media and politicians have a clear incentive to “convince” the public that we are “without a shred of doubt” going to have a recession and SOON!

The media is clearly incentivized by ratings and, whether we want to believe it or not, negative stories get better ratings by far. There is a human cognitive bias called the negativity bias that makes us all drawn to, and impacted more, by negative information than positive or neutral information. In fact, studies have shown that pessimistic people are perceived to actually be smarter than optimistic people, even if they are continuously wrong.[1]

The evolution of the so-called news media has been focused primarily on this concept. They understand these principles all too well and wield them against us for their own benefit. The below short video demonstrates this concept, and hopefully provides a bit of levity.

Disclaimer: The following paragraph may be perceived as “politically charged” due its nature, however we here at Delphi Advisers are politically agnostic and favor no specific party. In fact, we dislike all political parties and exercise our disdain from an equal opportunity perspective.

As for the incentives of politicians, it is really quite simple. Whichever party is not in power wants to convince us of how bad everything is. Right now, it is the Republican party claiming that the world is on fire and that we won’t survive unless they are voted back into office. I am sure those of you who lean left just got a slight feeling of giddiness as you read that last sentence, but don’t get too excited. This is something ALL politicians do regardless of party and the only thing we must do to prove this fact is wait. What Democrats are doing right now is figuring out ways to shield themselves from any potential negative outcome. This means, propping up the Federal Reserve as a saint and demonizing Russia for all that’s bad in the world. If there are negative outcomes and we do end up in a recession, then the Federal Reserve will quickly join Russia and be declared a demon by the Democrats to ensure that the public has someone to blame other than the elected officials. There are no heroes in politics, only survivors.

What is a Recession?

A clear picture has been painted as to why everyone is saying or thinking that we are heading into a recession. However, are there any merit to these ideas? To answer this question, we need to know what a recession truly is and why it’s important.

Recession Defined

There are many different interpretations and definitions of a recession. One that is quoted most often by the media is “two consecutive quarters of negative GDP”. GDP stands for Gross Domestic Product and is an incredibly complex set of calculations meant to capture the dollar value of a country’s production over a specified period of time. Without getting into the details about the GDP calculation itself, the most important thing to note is that GDP is a backwards-looking data point that takes months and months to calculate. There are at least three different releases of quarterly GDP figures called the “advanced”, “preliminary”, and “final” GDP.[2] (The term “at least” is used because sometimes there are more than three revisions/estimates.) The final GDP comes out at the end of the following quarter. For instance, the final GDP estimate for the first quarter of 2022 was released on June 29th, 2022. This is important because it can literally be months after we are already in a recession before it is officially recognized, or reversed, and has no real bearing on the future. For example, if the first half of 2022 was, in fact, a recession, we wouldn’t know for sure until the end of September (or even longer in some cases).

Even though the “rule of thumb” is two consecutive quarters of negative GDP, the National Bureau of Economic Research or NBER is the authority that officially calls a recession and determines its dates. The NBER defines a recession as:

“A significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee’s view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.”[3]

If things weren’t already confusing enough, the NBER’s definition offers no numbers or tangible criteria, just a judgement call that is not terribly helpful.

First Quarter 2022 GDP

Much of the hand wringing over a potential recession is based on the first quarter 2022 GDP release that came in at a -1.6% annual rate.[4] If the first quarter GDP was negative, inflation is running wild, shortages around the world continue, remnants of COVID persist, and there is a war in Ukraine, how can a second quarter of negative GDP not thrust us into a recession (at least unofficially)?

This is where a healthy distrust of the media and politicians can come in handy. The -1.6% annual decline in GDP is what’s referred to as “Seasonally Adjusted Real GDP”. This means that the numbers are adjusted based on the potential seasonal effects and inflation estimates, which create a lot of room for error in reporting. This is especially true considering that COVID lockdowns have distorted both seasonal phenomena and inflation numbers. To strip out the fuzziness of this data, we need to look at the raw numbers, specifically the nominal GDP.

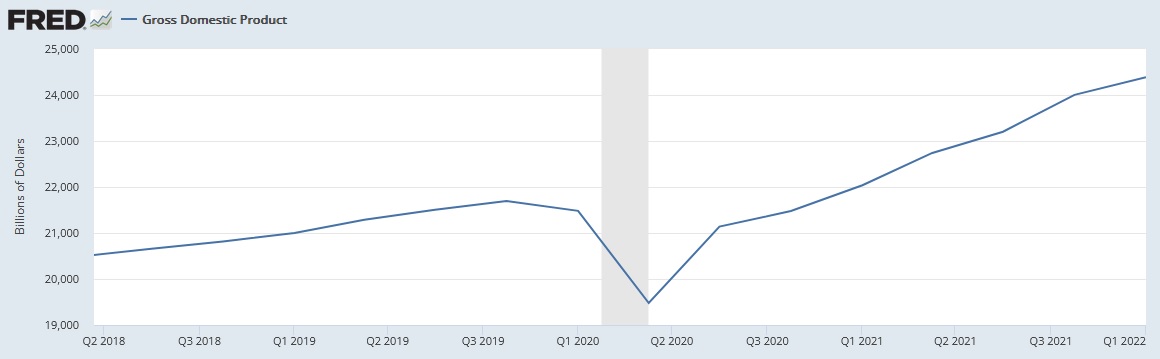

As you can see in Figure 1 below, nominal GDP, which is non-adjusted and reported in current dollars, rose from ~$24 trillion to ~$24.38 trillion, which represents an annual growth rate of about 6.5%.[5]

Figure 1: US Nominal GDP

So, did we actually experience negative GDP in Q1? It seems hard to swallow considering the economy grew by over $380 billion nominally. Simply put, more money was spent and more production took place in the first quarter of 2022 than during the fourth quarter of 2021. I think an argument can be made that this data demonstrates stagflation, but saying that it is recessionary is a stretch.

Leading Economic Indicators

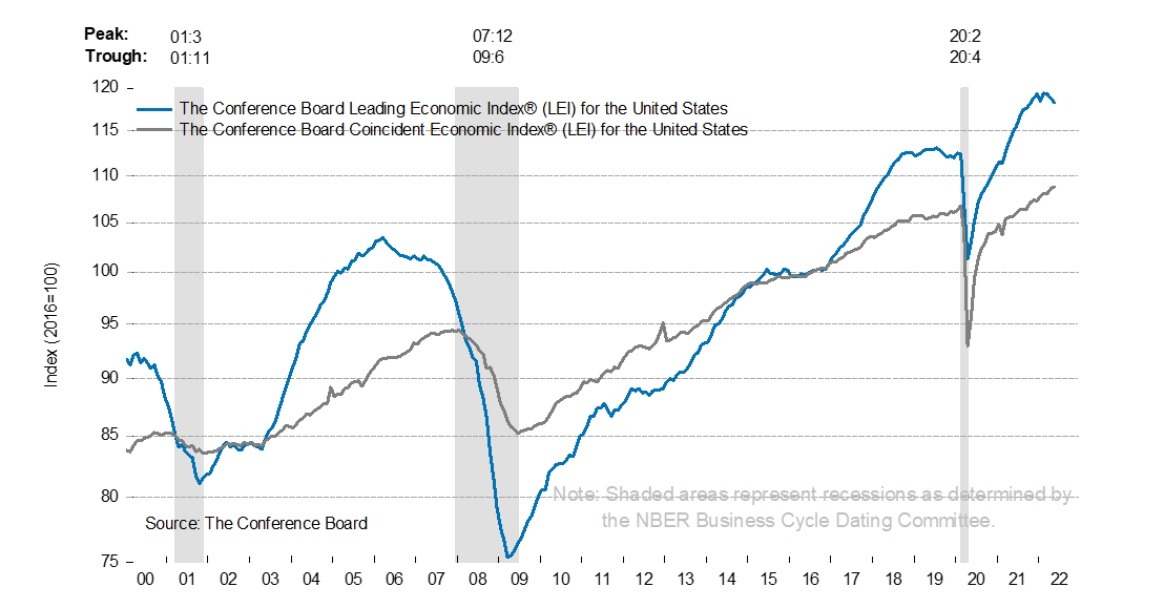

As mentioned previously, GDP and the other means of identifying a recession require us to look backwards. These stats tell us what has happened, not what is going to happen or what to expect for the future. There is no perfect way to predict the future, but there are indicators that are much more forward-looking than GDP, which are called Leading Economic Indicators. A company called The Conference Board has been working for years to put together an aggregate composite of these indicators to help predict future economic outcomes. This is called the Leading Economic Index or LEI.

As depicted in Figure 2 below, the LEI has fallen slightly over the last couple of months, which is not uncommon, but means that further research is needed to get a complete understanding of what to expect going forward.

Figure 2: Leading Economic Index

One of the hardest parts of predicting economic outcomes is that the sentiment of the consumer can become a self-fulfilling prophecy or simply noise that distracts us from reality. In order to try and capture this phenomenon, the Conference Board has included two components in the LEI, the S&P 500 price return and the average consumer expectations for business conditions. These are generally great components, but are by far the most volatile and account for the vast majority of short-term change in the index. Every time there is a stock market correction in the S&P 500 that is over ~10%, you tend to see the LEI slip a bit. This doesn’t mean a recession is on the horizon, it simply means that there is fear out there effecting forward-looking expectations. In order to account for the “fear” component of the LEI, we need to strip out the S&P 500 and consumer sentiment portions. This leaves us with seven publicly available components of the ten elements that make up the LEI.

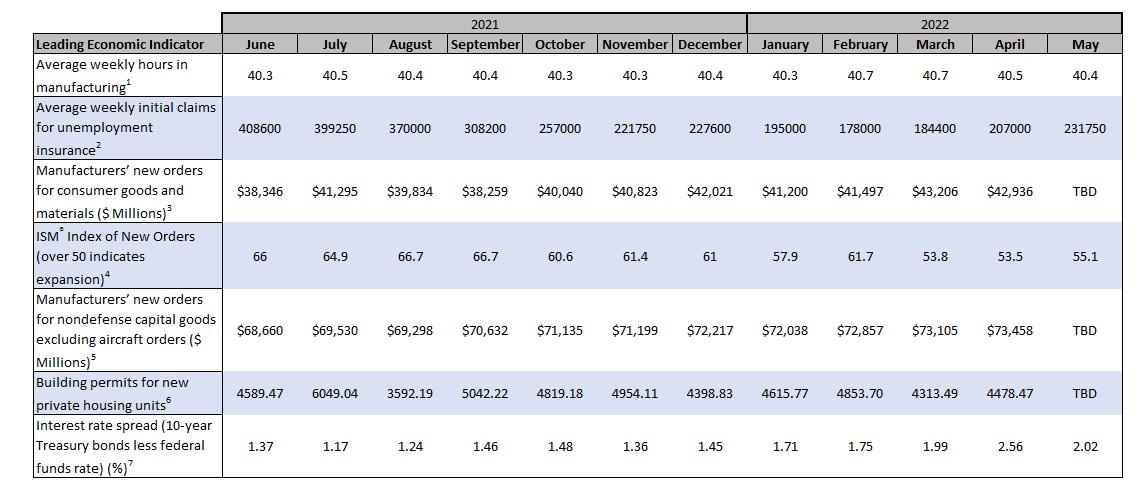

Figure 3: 7 Publicly Available Components of the LEI

Figure 3 above is a chart of the seven available components of the LEI over the last 12 months. As you can see, there does not appear to be a downward trend in any of these components. Perhaps some flattening or slower growth, but nothing that would indicate a long-term downtrend. Just like when we dove into GDP earlier, Americans are buying more and producing more than we have in the past.

This doesn’t mean that new data will not come out that contradicts the current numbers, but, in general, it takes multiple months of negative data to knock the economy off track. The LEI is a great tool, but one or even a few months of a slight decline does not foreshadow a recession. As you can see from Figure 2 above, the LEI tends to be flat or negative for many months, or even years, before a recession hits. That is just not what we are seeing right now.

Additional Note on the Yield Curve

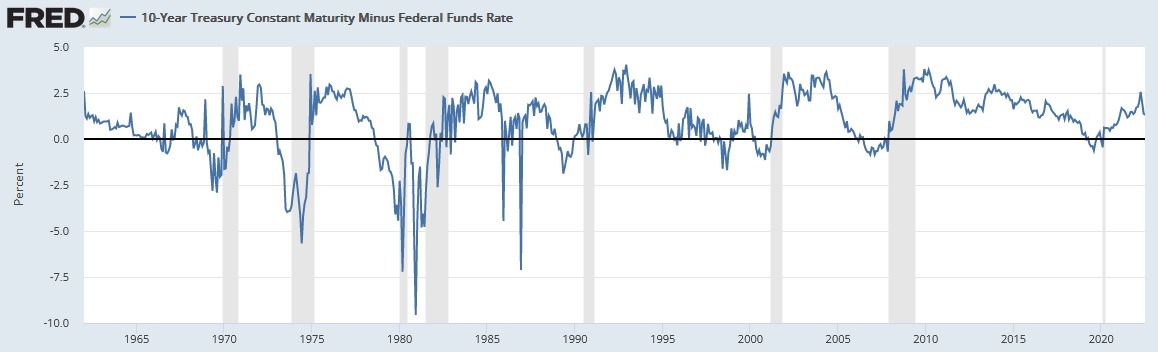

Arguably, the most important leading economic indicator is the yield curve, or more specifically, the difference in interest rates between the 10-year treasury yield and the Federal Funds Rate. We will save the grueling details of how this works for another article, but, in general, banks take in deposits and pay interest on them at short rates, which are dictated directly by the Federal Funds Rate. Banks lend out money at long rates, which are represented by the 10-year treasury yield. Therefore, the lending profitability of banks is a close reflection of the yield curve itself. If long rates are higher than short rates, lending is profitable and banks will continue to push money into the system and stimulate economic growth. The steeper the curve, the more banks lend. Conversely, if short rates rise above long rates, then lending is not profitable, which means banks will simply stop lending and liquidity will dry up in the months to follow. Right now, the yield curve is quite positive, which is a really good indicator of liquidity and future growth. As depicted in Figure 4 below, the yield curve has gone negative prior to every major recession dating back to the 1960s.

Figure 4: Yield Curve: 10-Year Treasury Yield minus Fed-Funds Rate

This doesn’t mean that there have not been false inversions that didn’t result in a recession. It just means that we tend to see an inversion prior to entering a recession. With that said, right now, there is no such inversion.

Conclusion and Risks

By taking a look at all the data, both leading and lagging, it seems like a recession is unlikely in the near term. If Q2 of 2022 has negative real GDP, but positive nominal GDP, as we saw in Q1, there is no doubt that the talking heads are going to call it a recession. The media is going to go crazy over it, Republicans are going to blame the Democrats, while the Democrats are going to blame Russia and the Federal Reserve. However, just because people are saying it, does not make it true. We are going to have to wait to see if the NBER comes out and calls it a recession or not. Even then, the NBER might revise their decision months or years down the road. That’s politics and economics for you. By the time we actually know “officially”, none of it will matter.

The reality is, for an investor, what has happened in the past or what we end up labeling the past is completely moot. Global capital markets are forward looking and, right now, they have priced in a lot of fear and misery. Fear causes short-term price instability, but is the precursor for market growth. With all the fear there is in the world, a positive surprise becomes more and more likely. When fear has deeply saturated the market and economies, it does not take an amazing positive surprise to move markets upwards, just “less bad” news. Slightly less inflation, a small change in the Ukraine war, a little more oil coming into the market is all it may take to see a complete turnaround and the beginning of shifting sentiment.

The data seems to point to continued nominal economic expansion in Q2 and beyond, but there are two major risks that can quickly change the narrative and need to be watched. First, if the Federal Reserve gets too aggressive too quickly, they could cause a yield curve inversion that could dry up liquidity and put the US on a recessionary path. However, this can take months, as liquidity does not dry up immediately. Second, another set of lockdowns brought on by COVID policy could seriously derail global economic growth far more quickly than a FED misstep. This is of particular risk in Asian countries like China that have COVID-Zero policies and believe they have the power to eradicate the virus with lockdowns. These risks seem unlikely in the near term, but we are watching them closely for changes.

If you have any questions, please do not hesitate to contact us.

Previous – Market Myths Series #1: Inflation is Bad For Stocks

Next – Market Myths Series #3: The Federal Reserve Can Stop Inflation

Footnotes:

[1] https://blog.rootsofprogress.org/why-pessimism-sounds-smart

[2] https://www.stlouisfed.org/on-the-economy/2014/may/do-revisions-to-gdp-follow-patterns

[3] https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions

[4] https://tradingeconomics.com/united-states/gdp-growth

[5] https://www.bea.gov/news/2022/gross-domestic-product-second-estimate-and-corporate-profits-preliminary-first-quarter