Tag: Financial Planing

Medicare: Understanding Parts A, B, C, & D

Whether your 65th birthday is on the nearing or many years away, understanding the different components of Medicare, referred to as “parts”, is critical to long term retirement planning. For good reason, many Americans are incorporating this government-sponsored program into their health care planning strategy. Learn about the different parts of Medicare to determine what […]

Read more

Inflation Creeping into Personal Finances

Inflation creep is in full effect and it is starting to have an impact on our budgets and personal financial situations. If you have a balance on a credit card or an adjustable rate mortgage, you might be noticing changes in your payments. Higher interest rates are starting to ripple through the personal finance landscape, […]

Read more

What’s My 2022 Tax Bracket (infographic)

Tax brackets change pretty much every year, and 2022 is no different. As we do tax planning for the upcoming year it is very important to identify where we are in the 2022 tax brackets so we know how much the marginal dollar will be taxed and if it makes sense to do things like […]

Read more

Restricted Stock Units (RSU): Understanding Your Equity Compensation Options

When it comes to compensation, many companies are now providing equity and stock-based benefits to their employees. Each type of benefit has its own set of rules, and it’s essential to understand the nuances of each type. One form of equity-based compensation is restricted stock units (RSUs). Here’s what you need to know about this […]

Read more

Tax Strategies for High Earners

Preparing tax strategies that are both advantageous and tax-efficient might feel daunting at first. Thankfully, there are some things you can do now to keep from overpaying this tax season. Build Your Team of Professionals You might build a team for any number of pursuits, from organizing a baseball team to putting together people to […]

Read more

Primer on the UAL Pilot Retiree Health Account (RHA)

The Retiree Health Account (RHA) is a very unique benefit that United provides to its pilots. It is funded by employer contributions on a pre-tax basis and designed to pay for medical expenses, tax-free, after retirement or separation of service. When used properly, the RHA can be a key part of a pilot’s retirement plan. […]

Read more

Sorry, You’re Biased Toward Your Own Money. Here’s What We Can Do About It

In one way or another, we all have a complex relationship with our own money. Because of that, it’s hard to be rational all the time in how we use it. But where do our behavioral biases come from, and what can we do to counteract them? We explore these questions below. Emotions Lead to […]

Read more

Will Taking a COVID-19 Vaccine Void Your Life Insurance?

Recently, there has been a lot of chatter on social media about COVID-19 vaccines and life insurance. The conjecture is: if you get a vaccine and pass away as a result, your life insurance policy will be void and your beneficiaries will get nothing. This seems to come from the idea that if you die […]

Read more

The American Rescue Plan Act Has Passed: Overview of the $1.9 Trillion Stimulus Plan

In one of his first major moves in office, President Biden has signed the American Rescue Plan Act – a $1.9 trillion stimulus plan meant to extend, renew and implement relief for those affected by COVID-19. Below is a breakdown of some important components to this legislation, including what business owners, families and struggling individuals […]

Read more

8 Financial Vows to Make for 2021

2020 was a year most of us would prefer to forget. When the year started, nobody expected natural disasters of historic proportion, the COVID-19 pandemic, global lock-downs, travel bans, school closures, or the resulting economic hardships that followed. But with the first year of the new decade officially behind us, how can we better prepare […]

Read more

The Paycheck Protection Program Has Received Additional Funding for 2021. Here’s What Small Business Owners Need to Know.

Self-employed individuals and small businesses account for a significant portion of our country’s economy. During a global pandemic, like the one we’re experiencing now, small businesses suffer some of the hardest hits. Last March, the CARES Act allocated funding to support the U.S. economy and workers through the Coronavirus pandemic. The legislation included a number […]

Read more

Scammers Are Getting Smarter in 2020: Here Are 5 Ways to Spot Them

Scammers are taking advantage of citizens in an already anxiety-inducing climate during the COVID-19 pandemic. Be aware of these five red flags when getting on the phone, checking your email or using social media. This can help you avoid even getting trapped in a conversation with a scammer in the first place. This content is […]

Read more

What Could Election Results Mean For Your Future Estate Taxes?

November is finally here and election day approaches rapidly – which means the relentless political ads, phone calls and social media posts are (thank goodness) coming to an end. As we spend the next few weeks discussing and determining the future of our country for the next four years, it’s important to prepare for potential […]

Read more

6 Common Financial Stress Triggers and How to Overcome Them

As companies continue to navigate the uncertainties that have come with the coronavirus pandemic and employees figure out their day-to-day routine, financial stress triggers are bound to occur. While feelings of stress and anxiety are certainly heightened amidst the current pandemic, feeling stressed about your finances isn’t anything new. In fact, an American Psychological Association […]

Read more

4 Areas of Your Estate Plan to Review in Light of COVID-19

Although COVID-19 related restrictions are beginning to ease, many people continue to help slow the spread by staying home and self-isolating. There are still unknowns related to the pandemic and how it will play out, undoubtedly keeping us all on edge. Over the past few months, we’ve been forced to face fears of falling ill, […]

Read more

Roth Conversions: What You Need to Know

When opening a retirement savings account, you’re typically presented with the option of choosing between a traditional or Roth IRA. While you may have stuck with a traditional IRA for the initial tax savings, it’s possible you could change your mind and opt for tax-free retirement income instead. Making this switch is called a Roth […]

Read moreInfographic: Your 7-Step Summer Financial Checkup

This content is developed from sources believed to be providing accurate information, and provided by Twenty Over Ten. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, […]

Read more

Bullet Journaling Your Way Toward a Budget

Most of us have tried at least once to set a budget and stick to it. For many, apps on their phone or spreadsheets on the computer help them achieve this task. But for those with a more creative side, these types of tools may not work. That’s where bullet journaling comes in. What is […]

Read more

A Guide to Managing Your Money During the COVID-19 Pandemic

As COVID-19 continues to spread throughout the globe, individuals are adjusting to new lifestyles in an effort to curb the spread. While there are many factors of this pandemic we cannot control, practicing social distancing and creating new routines to remain physically and psychologically healthy are just a few of the actions we can take. […]

Read more

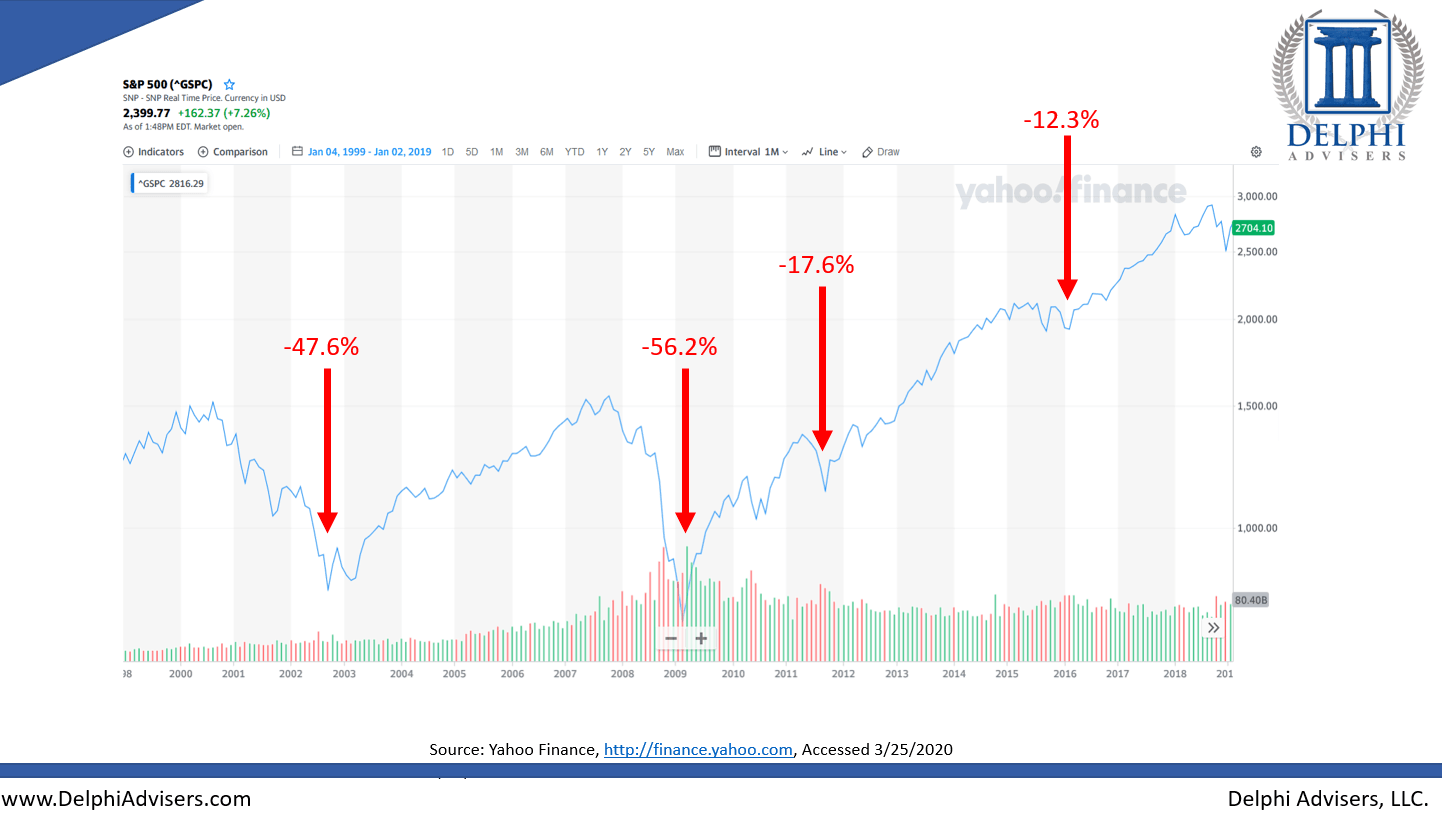

Investor Alert: Surviving Volatility

Covid-19 and its’ implications have caused an extreme amount of volatility in the markets and it has been very taxing on humanity and investors alike. When we go through a sharp downturn like this one, it is incredibly difficult to try and figure out what to do. In this video our President and Chief Investment […]

Read more

Lifestyle Creep: Keeping up with the Jones’

We all inherently know that the way to become wealthy is to save our money and invest, but it is more easily said than done. As we get older and make more money, we have a tendency to spend that extra cash on “stuff” that we probably don’t need but provides us societal status, or […]

Read more

Is Buying a Home Really the Right Choice?

Buying a house is something that most Americans strive to do in their lifetime, and it can definitely be a rewarding endeavor. However, believe it or not, a single-family home has not historically been a great investment. We all need a place to live, and in many cases, buying can be better than renting since […]

Read more