Tag: Investing

Iran Strikes Rattle Markets – Is This Volatility a Warning or Just Noise?

Our thoughts go out to those affected around the world Before we talk about markets, it’s worth recognizing the obvious: war is, first and foremost, a human tragedy. The loss of life, the fear, and the uncertainty endured by millions of people far outweigh any financial ripple. It’s a stark reminder that behind every headline […]

Read more

Tariffs, Turmoil, and Truth: Debunking the Fear of Economic Collapse

We currently find ourselves in a very volatile market driven by fear and uncertainty courtesy of the expansive tariff policy being enacted by the Trump administration. As I write this article, the S&P 500 is down 4% in a single day, which represents the largest one-day selloff since 2022. This volatility encapsulates the fear generated […]

Read more

Politics vs. Portfolios: Decoding the 2024 Election Impact

Well, it’s election season, our favorite quadrennial event here at Delphi Advisers. Just in case the written word did not convey the sentiment properly, that was sarcasm. None the less, it is time to analyze the 2024 election impact on markets. The 2024 presidential election is upon us along with a slew of misinformation and […]

Read more

Shutdown Shock: Government Shutdowns & Market Reaction

In case you didn’t know, a government shutdown is imminent and life as we know it will change forever………again. Or, at least, that’s what the media and our government officials want us to believe. Well, that may be too harsh. How about this? They don’t care what we believe. They’re all making moves that are […]

Read more

Bank Failures in Context – Slivergate, Signature, and SVB

Over the last couple of days, we have seen a media storm about recent bank failures and how these failures may (or may not) signal upcoming bank runs and a crisis in the overall financial system. Is there any truth to this media blitz or is it just more run-of-the-mill fear mongering to boost ratings? […]

Read more

Know The Risks: Market, Interest Rate and Currency Risk

Currency Risk History has shown that successful investing requires discipline and patience. When emotions and investment risks run high, it can be easy to lose focus on your investment strategy. To help you overcome these challenges and start thinking about the design of a risk management strategy, here are some important items to keep in […]

Read more

Understanding Strategic Diversification

When you created your investment strategy, your asset allocation reflected your goals, time horizon and tolerance for volatility. Over time, however, any of these three factors, or others, may have changed, and your portfolio may need adjustments to reflect your new investing priorities. You may also need to re-evaluate the effectiveness of your risk mitigation […]

Read more

Why Modern Portfolio Theory Still Matters

Two different belief systems serve as the basis for investment decisions: the modern portfolio theory (MPT) and behavioral finance (BF). A basic summary of the two schools of thought: the MPT focuses on the optimal state of the market, while BF is more focused on the actual state of the market. While an understanding of […]

Read more

Restricted Stock Units (RSU): Understanding Your Equity Compensation Options

When it comes to compensation, many companies are now providing equity and stock-based benefits to their employees. Each type of benefit has its own set of rules, and it’s essential to understand the nuances of each type. One form of equity-based compensation is restricted stock units (RSUs). Here’s what you need to know about this […]

Read more

Sorry, You’re Biased Toward Your Own Money. Here’s What We Can Do About It

In one way or another, we all have a complex relationship with our own money. Because of that, it’s hard to be rational all the time in how we use it. But where do our behavioral biases come from, and what can we do to counteract them? We explore these questions below. Emotions Lead to […]

Read more

Inflation in 2021: What Investors Need to Know

Following a year of economic instability, it appears that many of us are turning our attention to something that’s been around for decades, but has recently piqued national interest – inflation. In fact, a recent study found that people are Googling the word “inflation” at a rapid rate, with a peak not seen since 2008.1 […]

Read more

Analyzing The UAL PRAP: Investment Decisions

If you are a Pilot for United Airlines you have a great 401(k) plan called the Pilot Retirement Account Plan (PRAP), but there are a lot of factors that need to be analyzed before making investment decisions. In this article we are going to take you through the investment options and the extrinsic factors that […]

Read more

8 Financial Vows to Make for 2021

2020 was a year most of us would prefer to forget. When the year started, nobody expected natural disasters of historic proportion, the COVID-19 pandemic, global lock-downs, travel bans, school closures, or the resulting economic hardships that followed. But with the first year of the new decade officially behind us, how can we better prepare […]

Read more

Does Impeachment Impact the Markets? Let History be Our Guide.

On Jan. 13, President Donald Trump was impeached for a second time by the House of Representatives – a first for our nation. President Trump was impeached for his part in inciting violence against the United States government.1 This move came days before President Trump was set to leave office, but it still begs the […]

Read more

Elections and Markets: Half the Country Will be Disappointed……..Count on it!

We are living in one of the most divisive times I can ever remember when it comes to politics. It seems no matter what happens people are going to be angry and frustrated and there is really nothing that can be done about it. These are just the times we live in, fear and fervor […]

Read more

6 Common Financial Stress Triggers and How to Overcome Them

As companies continue to navigate the uncertainties that have come with the coronavirus pandemic and employees figure out their day-to-day routine, financial stress triggers are bound to occur. While feelings of stress and anxiety are certainly heightened amidst the current pandemic, feeling stressed about your finances isn’t anything new. In fact, an American Psychological Association […]

Read more

Coronavirus: Why Your Next Moves Are More Important Than the Market’s

As of June 26, 2020, 9,473,214 cases of COVID-19 were reported, with the death toll reaching 484,249.1 With the number of infected patients rising every day, it’s nearly impossible to avoid feeling stressed or anxious about the world’s most recent pandemic. Aside from the concerns for our health, the financial toll of the Coronavirus pandemic […]

Read more

2020 Tax Code Changes: What You Need to Know

Taxes may be the last thing on your mind considering the turmoil and civil unrest resulting from recent events. Unfortunately, Uncle Sam is going to want his cut at some point. Here is what you need to know.

Read more

Investor Alert: Surviving Volatility

Covid-19 and its’ implications have caused an extreme amount of volatility in the markets and it has been very taxing on humanity and investors alike. When we go through a sharp downturn like this one, it is incredibly difficult to try and figure out what to do. In this video our President and Chief Investment […]

Read more

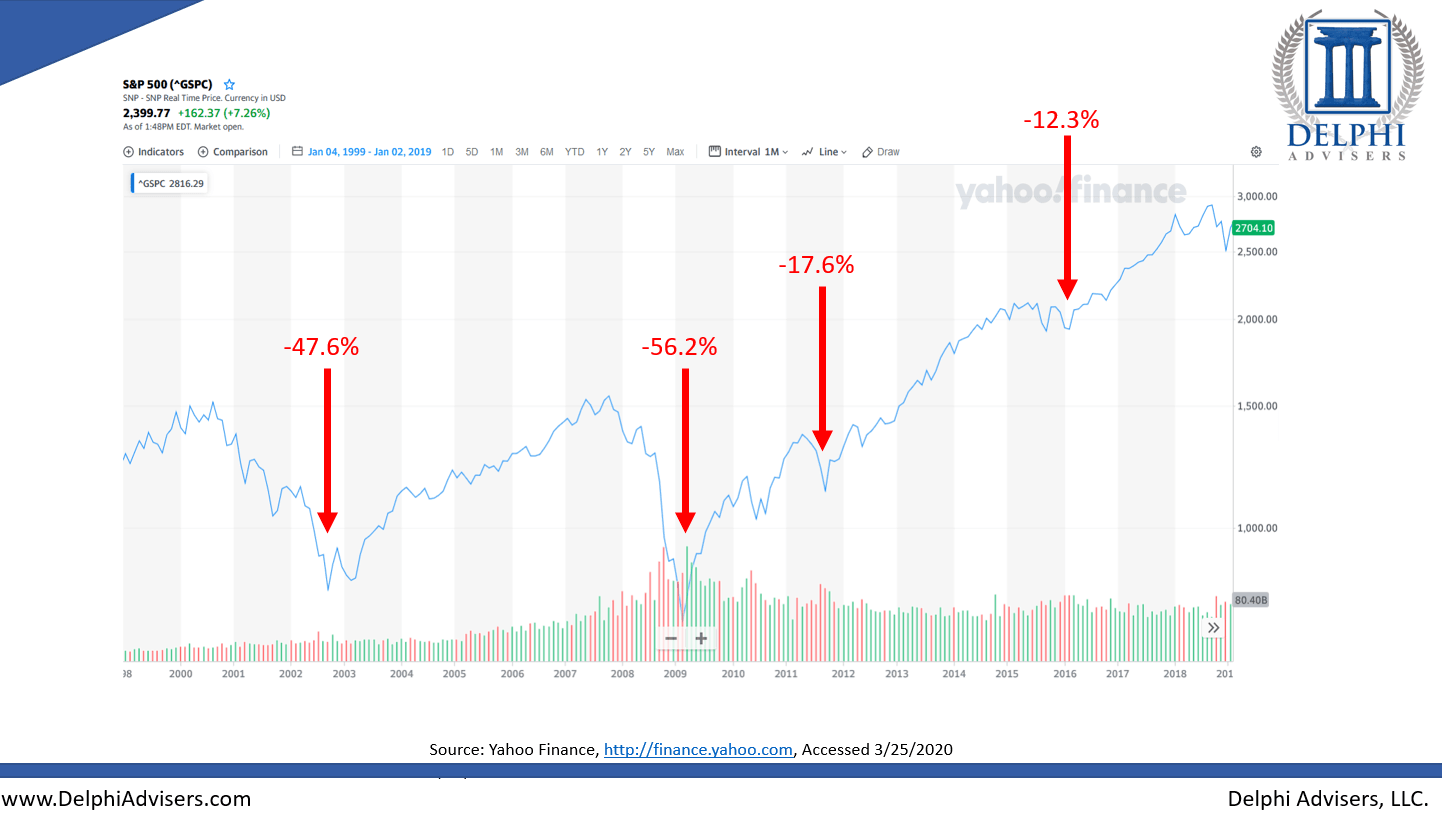

The Coronavirus: The Human Toll, Historical Perspective, and Market Impact

Markets continue to be extremely volatile due to fears of COVID-19, better known as the Coronavirus, but is it really warranted? For many people, this virus has been very difficult and affected them in very adverse ways including loss of wages, illness, and even the death of loved ones, our thoughts and well wished go […]

Read more

Lifestyle Creep: Keeping up with the Jones’

We all inherently know that the way to become wealthy is to save our money and invest, but it is more easily said than done. As we get older and make more money, we have a tendency to spend that extra cash on “stuff” that we probably don’t need but provides us societal status, or […]

Read more

Is Buying a Home Really the Right Choice?

Buying a house is something that most Americans strive to do in their lifetime, and it can definitely be a rewarding endeavor. However, believe it or not, a single-family home has not historically been a great investment. We all need a place to live, and in many cases, buying can be better than renting since […]

Read more