Tag: Economics

Tariffs, Turmoil, and Truth: Debunking the Fear of Economic Collapse

We currently find ourselves in a very volatile market driven by fear and uncertainty courtesy of the expansive tariff policy being enacted by the Trump administration. As I write this article, the S&P 500 is down 4% in a single day, which represents the largest one-day selloff since 2022. This volatility encapsulates the fear generated […]

Read more

The Sahm Rule, Markets, and Recession

As this article is being written, there is a significant amount of downside volatility occurring within equity markets. The S&P 500 peaked on July 16th and, since that high, as of today (8/5/2024) we have seen it sell off 7.9%. The NASDAQ is officially in correction territory (down ~13.1% since it peaked on 7/11/24). One […]

Read more

Shutdown Shock: Government Shutdowns & Market Reaction

In case you didn’t know, a government shutdown is imminent and life as we know it will change forever………again. Or, at least, that’s what the media and our government officials want us to believe. Well, that may be too harsh. How about this? They don’t care what we believe. They’re all making moves that are […]

Read more

Bank Failures in Context – Slivergate, Signature, and SVB

Over the last couple of days, we have seen a media storm about recent bank failures and how these failures may (or may not) signal upcoming bank runs and a crisis in the overall financial system. Is there any truth to this media blitz or is it just more run-of-the-mill fear mongering to boost ratings? […]

Read more

Market Myths Series: The Fed Can Stop Inflation

Over the last few months, we have seen a pretty drastic change in not just the policy stance of the Federal Reserve, but how the organization is viewed and being used as a prop by our elected officials. With midterm elections around the corner, the Republicans are trying to position the Federal Reserve as an […]

Read more

Market Myths Series: A Recession is Imminent

If you watch the news, listen to the radio, or generally socialize with other people, you have probably heard the whispers (or screams) claiming that, if we are not in a recession already, then one is right around the corner. But is there any truth or legitimacy to these claims? The reality is that no […]

Read more

The Great Resignation: Why More Americans Are Retiring Now Than Ever

They’re calling it the Great Resignation. This unprecedented phenomenon is observing numerous Americans leave their jobs—some for greener pastures, others for extended periods, and still others, especially older Americans, for retirement. While endless column inches on this matter have been published, one of the big questions is why it’s happening here and now. The most […]

Read more

Know The Risks: Market, Interest Rate and Currency Risk

Currency Risk History has shown that successful investing requires discipline and patience. When emotions and investment risks run high, it can be easy to lose focus on your investment strategy. To help you overcome these challenges and start thinking about the design of a risk management strategy, here are some important items to keep in […]

Read more

Inflation in 2021: What Investors Need to Know

Following a year of economic instability, it appears that many of us are turning our attention to something that’s been around for decades, but has recently piqued national interest – inflation. In fact, a recent study found that people are Googling the word “inflation” at a rapid rate, with a peak not seen since 2008.1 […]

Read more

Investor Alert: Surviving Volatility

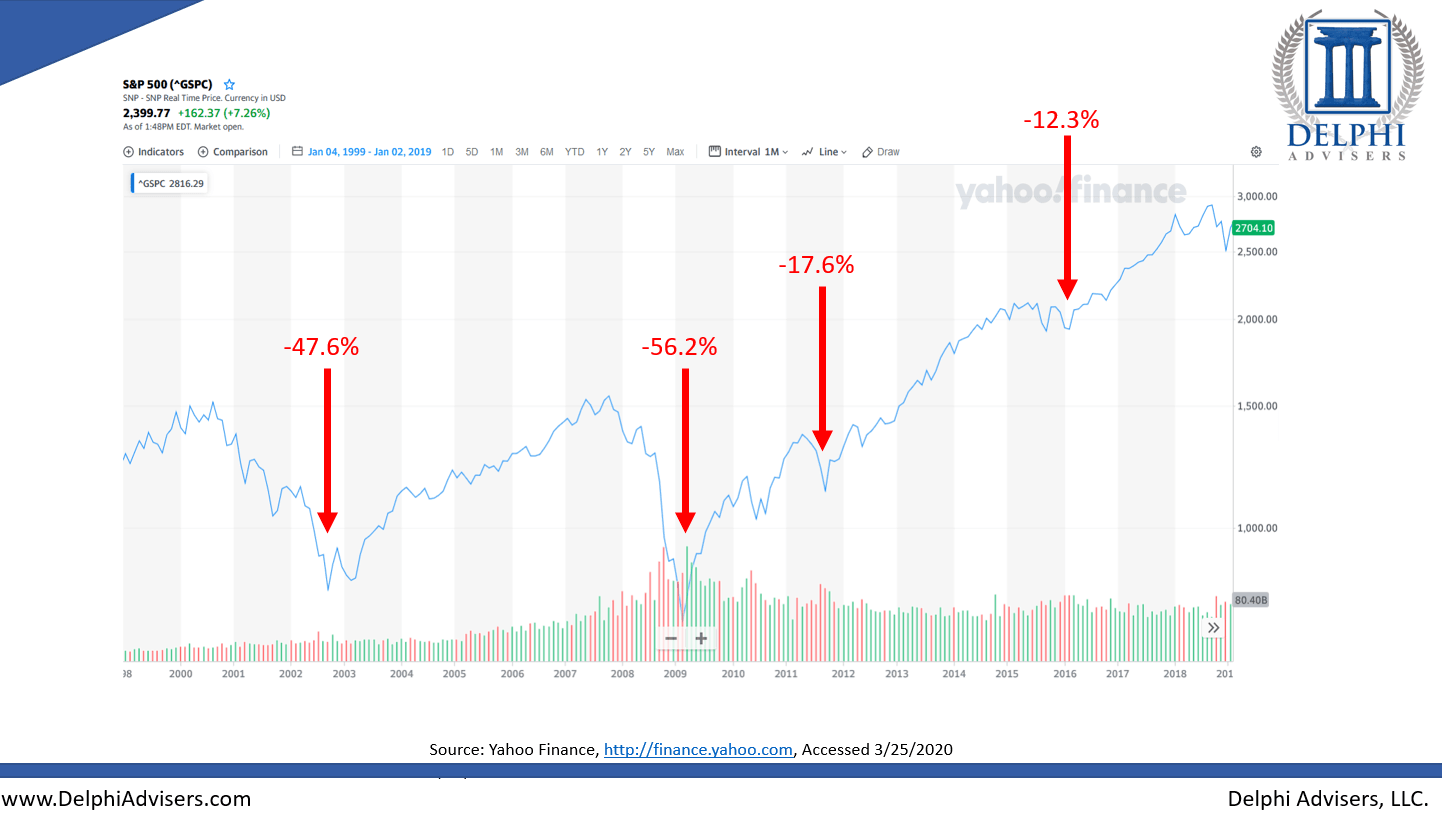

Covid-19 and its’ implications have caused an extreme amount of volatility in the markets and it has been very taxing on humanity and investors alike. When we go through a sharp downturn like this one, it is incredibly difficult to try and figure out what to do. In this video our President and Chief Investment […]

Read more

The Coronavirus: The Human Toll, Historical Perspective, and Market Impact

Markets continue to be extremely volatile due to fears of COVID-19, better known as the Coronavirus, but is it really warranted? For many people, this virus has been very difficult and affected them in very adverse ways including loss of wages, illness, and even the death of loved ones, our thoughts and well wished go […]

Read more

Negative Interest Rates: Is this Really Happening?

Central banks around the world have embarked on negative interest rates. Find out what they are and how they work in this analysis by Delphi Advisers.

Read more

Garbage In, Garbage Out – Consequences of Wrongheaded FED Policy

The FED is constantly making decisions that effect all of us, but ar they really helping?

Read more